30+ Mortgage calculator plus taxes

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

Yea Bmore Personal Finance Personal Finance Infographic Finance Infographic

Getting ready to buy a home.

. 30 years x 12 months per year From here you can find out your total monthly payment by adding in any other fees including the monthly payment amount for taxes and insurance find their annual costs and divide by 12 HOA or condo. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Filters enable you to change the loan amount duration or loan type.

For example a 30-year fixed-rate loan has a term of 30 years. The main parts of a mortgage. Early in the repayment period your monthly loan payments will include more interest.

You may not require mortgage default insurance and the maximum amortization. Once the loan term is up your mortgage should be paid off. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. Our calculator includes amoritization tables bi-weekly savings. Most people need a mortgage to finance a home purchase.

Living expenses and so on plus new expenses youd take on property taxes condo fees utilities you can get a reasonable estimate. A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. In return the borrower agrees to pay back the loan plus interest over the course of 15 or 30 years.

The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt. N How many payments youll make over the life of the loan For a 30-year mortgage thats 360 payments. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Then our free mortgage calculator will give precise data about monthly principal interest a number of total payments the total interest that you need to pay and payout date. How much money could you save. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

The loan term is the length of your mortgage. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

By default 250000 30-yr fixed-rate loans are displayed in the table below. If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents. Fill out the other important data taxes start date PMI etc only if they are different then the default data in the mortgage payment calculator and hit enter.

Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000. We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the.

Use the TD mortgage affordability calculator to determine a comfortable mortgage loan and price range for your new home. Todays mortgage rates in California are 5767 for a 30-year fixed 5119 for a 15-year fixed and 5198 for a 5-year adjustable-rate mortgage ARM. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Choose a 30-year fixed-rate mortgage which has equal payments over the life of the. Your mortgage principal interest real estate taxes home insurance and mortgage insurance plus any existing debts such as credit cards car loans or personal loans shouldnt exceed 43 - 50 of your gross monthly income income before taxes. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

Mortgage loan terms can vary but most borrowers choose either a fixed-rate 15-year or 30-year mortgage. Check out the webs best free mortgage calculator to save money on your home loan today. The period of time during which a loan must be repaid.

FHA loan calculator including current FHA mortgage insurance rates taxes insurance HOA dues and more. How to Use the Mortgage Calculator. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value. New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions. You can adjust your monthly.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. A mortgage is a loan you borrow to buy a home. For instance if you take out a 30-year mortgage that means youll make a monthly payment for 30 years.

See how changes affect your monthly payment. Add in taxes. Bank of America adjustable-rate mortgage ARM loans feature an initial fixed interest rate period typically 3 5 7 or 10 years after which the interest rate becomes adjustable for the remainder of the loan term.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

A Little Tax Relief For A Favorite Tax Accountant At Tax Time Bravo Baskets Accountant Gifts Client Appreciation Gifts Customer Appreciation Gifts

What Would My Yearly Salary Have To Be To Afford A 2m House Quora

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

10 Most Successful Real Estate Marketing Strategies Of All Time Brandongaille Co Real Estate Infographic Real Estate Marketing Real Estate Marketing Strategy

Adjusted Trial Balance Explanation Format Example Accounting For Management Trial Balance Accounting Accounting Basics

Laboratory Budget Template 3 Things You Need To Know About Laboratory Budget Template Today Monthly Budget Template Budget Template Budget Template Free

Free Household Budget Form Budget Forms Budget Planner Printable Household Budget

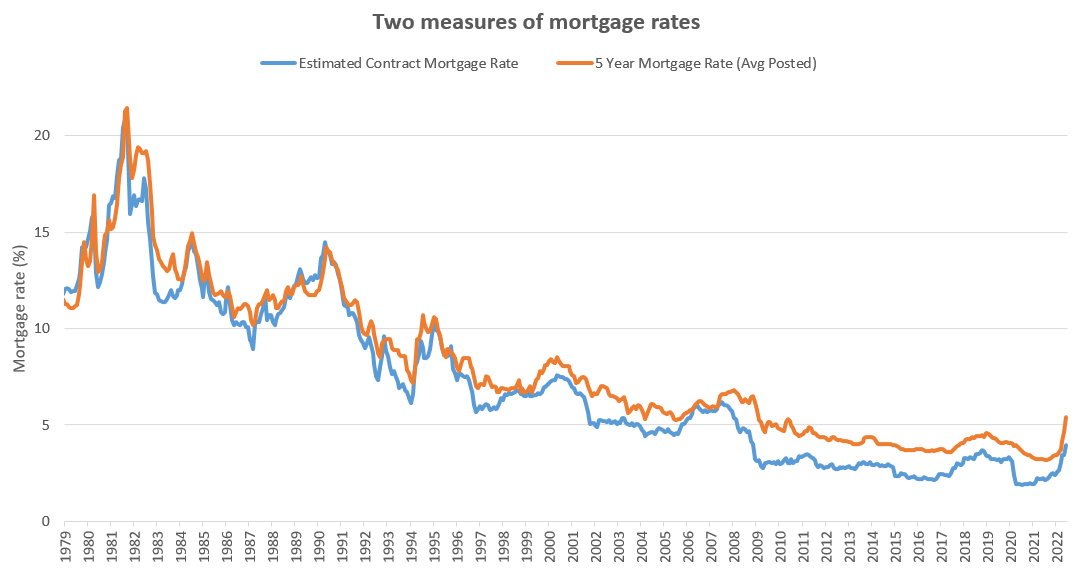

High Frequency Un Affordability House Hunt Victoria

Best Mortgages In Canada Comparewise

Best Mortgages In Canada Comparewise

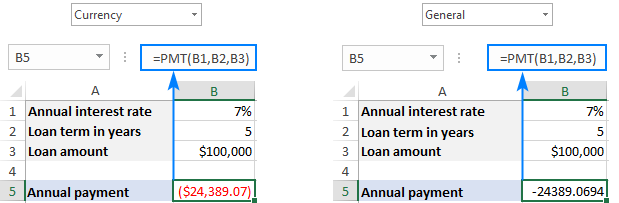

Excel Pmt Function With Formula Examples

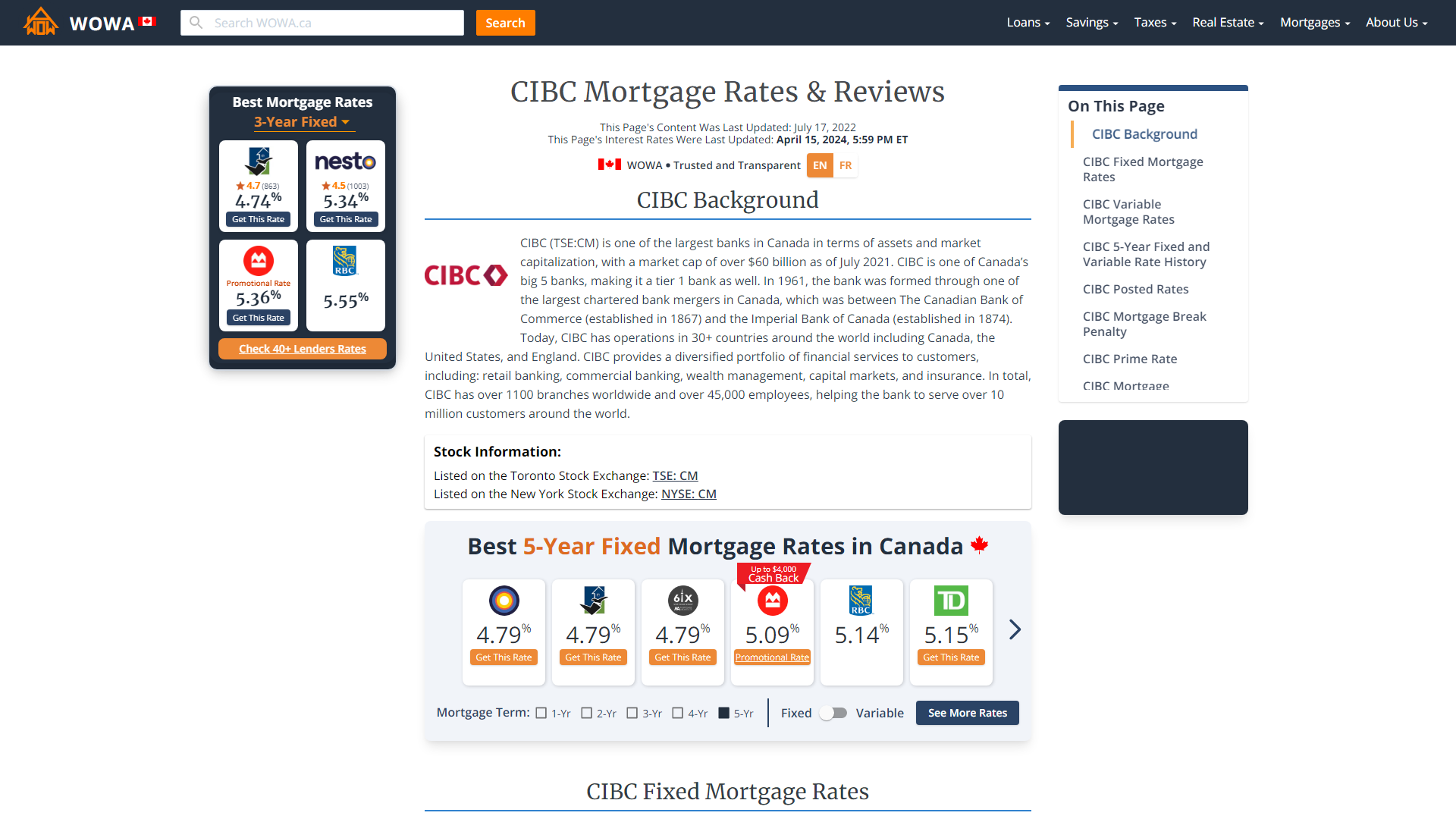

Cibc Fixed And Variable Mortgage Rates Sep 2022 From 5 14 Wowa Ca

Pin On Airbnb

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

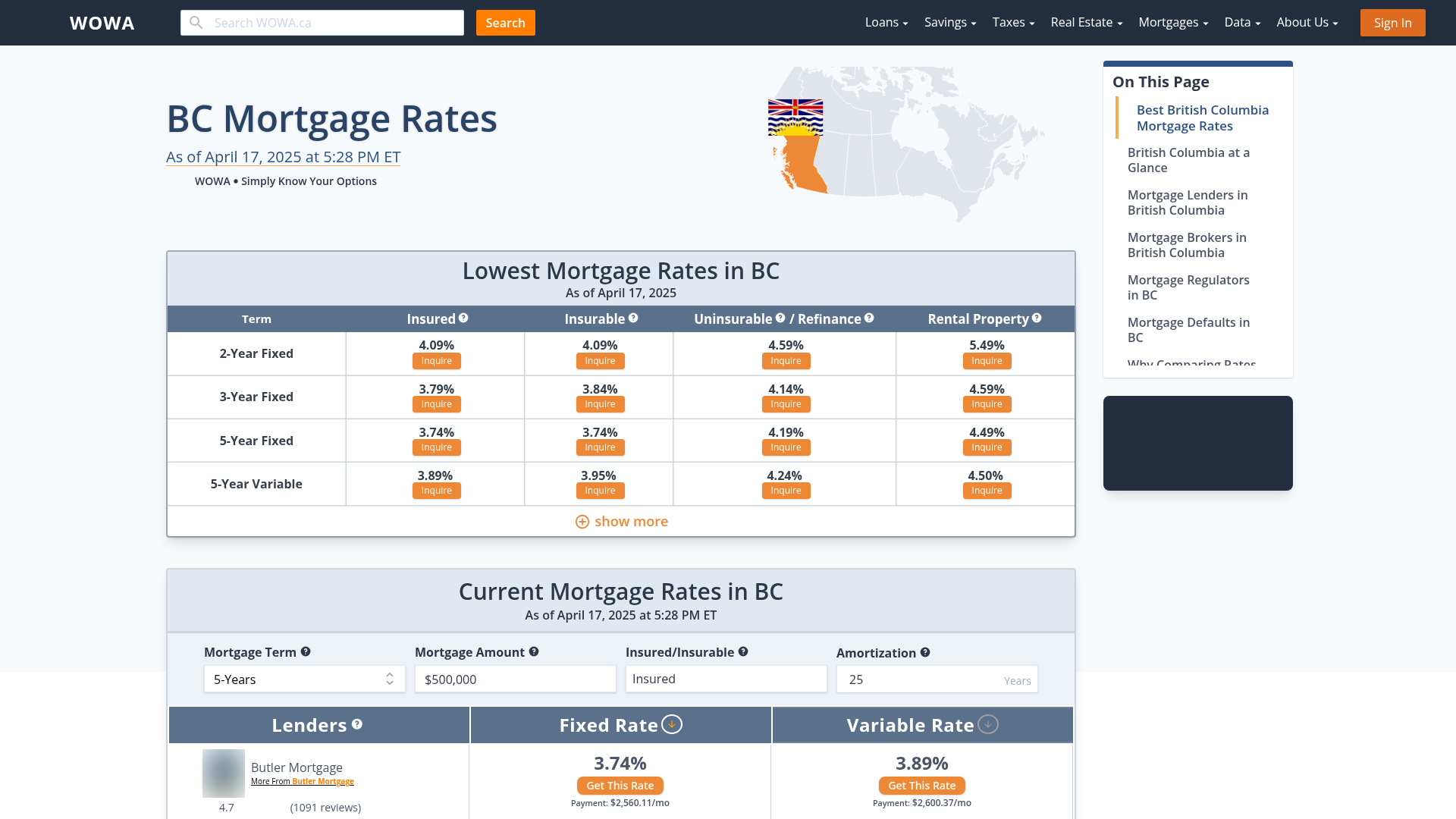

British Columbia Mortgage Rates From 30 Bc Lenders Wowa Ca

![]()

Plugins Categorized As Mortgage Calculator Wordpress Org English Canada